Welcome to the world of disaster insurance for homeowners! As a responsible homeowner, it’s crucial to understand the basics of disaster insurance to protect your investment in the event of a natural disaster. From understanding different types of coverage to knowing what is typically included in a standard policy, this article will provide you with the information you need to make informed decisions about protecting your home and assets. Let’s dive in and ensure you have the coverage you need for peace of mind. Have you ever wondered what disaster insurance is and how it can protect your home in the event of a natural calamity? In this article, we will delve into the basics of disaster insurance for homeowners, helping you understand the importance of having this type of coverage for your property.

Understanding Disaster Insurance

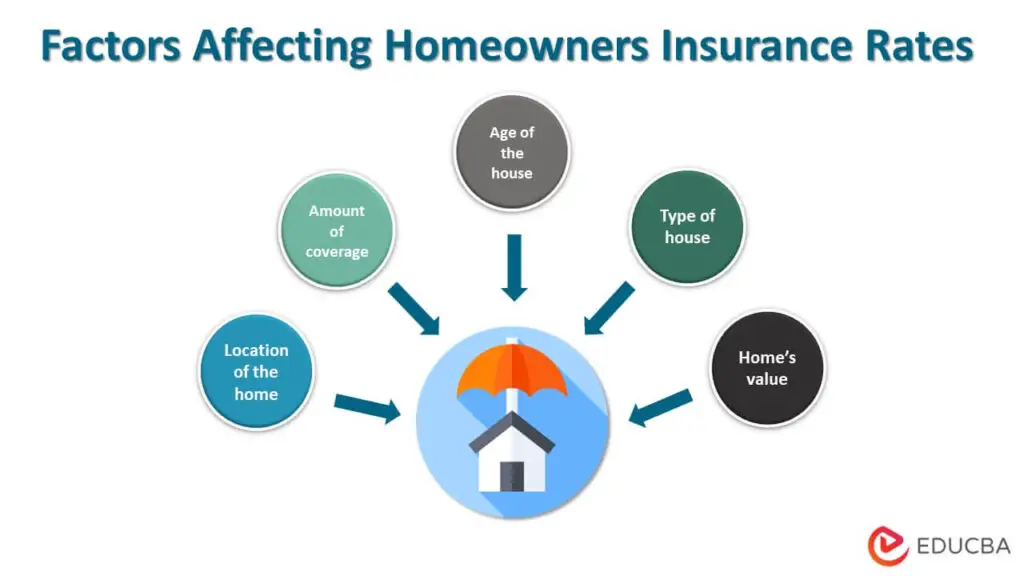

Disaster insurance is a type of coverage that homeowners can purchase to protect their property in the event of a natural disaster such as hurricanes, earthquakes, floods, or wildfires. This type of insurance is separate from your standard homeowners insurance policy and provides coverage for damage caused by these specific types of disasters.

Why Do You Need Disaster Insurance?

Disasters can strike at any time, and they can cause significant damage to your home and belongings. Without the proper insurance coverage, you could be left with a hefty repair bill that may be difficult to afford. Disaster insurance can help protect you from financial devastation in the event of a natural calamity.

Types of Disaster Insurance

There are several types of disaster insurance policies that homeowners can purchase to protect their property. These include:

Flood Insurance

Flood insurance provides coverage for damage caused by flooding, which is not typically covered by standard homeowners insurance policies. Flood insurance is especially important for homeowners living in flood-prone areas or areas with a high risk of hurricanes.

Earthquake Insurance

Earthquake insurance provides coverage for damage caused by earthquakes, which are also not typically covered by standard homeowners insurance policies. Homeowners living in areas with a high risk of earthquakes should consider purchasing this type of insurance to protect their property.

Hurricane Insurance

Hurricane insurance provides coverage for damage caused by hurricanes, including wind damage and flooding. This type of insurance is essential for homeowners living in hurricane-prone areas, as hurricanes can cause significant damage to homes and property.

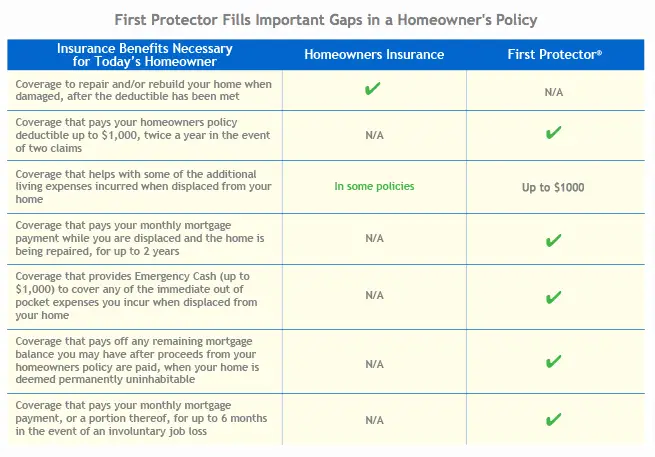

Coverage Limits and Deductibles

When purchasing disaster insurance, it is essential to understand the coverage limits and deductibles associated with the policy. Coverage limits refer to the maximum amount that the insurance company will pay out in the event of a disaster, while deductibles refer to the amount that you will need to pay out of pocket before your insurance coverage kicks in.

Understanding Coverage Limits

It is crucial to review your policy’s coverage limits to ensure that you have adequate coverage in the event of a disaster. If your coverage limits are too low, you may not receive enough compensation to cover the full cost of repairs or rebuilding your home. Be sure to discuss your coverage limits with your insurance agent to determine if any adjustments need to be made.

Calculating Deductibles

Deductibles can vary depending on the type of disaster insurance policy you have and the insurance company you are working with. It is essential to understand how deductibles work and how much you will need to pay out of pocket before your coverage kicks in. Be sure to have a clear understanding of your policy’s deductibles to avoid any surprises in the event of a disaster.

Choosing the Right Insurance Company

When it comes to purchasing disaster insurance, choosing the right insurance company is crucial. Here are some factors to consider when selecting an insurance company for your disaster insurance policy:

Financial Stability

It is essential to choose an insurance company with a strong financial standing to ensure that they will be able to pay out claims in the event of a disaster. Research the financial stability of the insurance company you are considering to ensure that they have the resources to cover your claim.

Customer Service

Customer service is another essential factor to consider when choosing an insurance company. Look for a company with a reputation for excellent customer service, as you will want a smooth claims process in the event of a disaster. Read reviews and ask for recommendations to find an insurance company that values their customers.

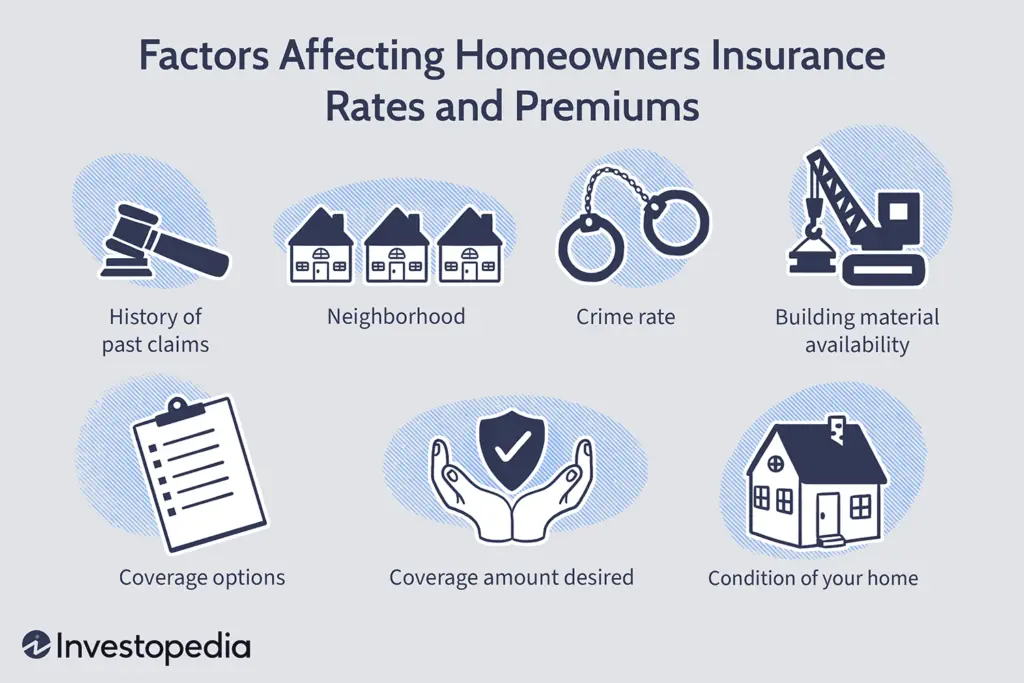

Coverage Options

Different insurance companies offer different coverage options for disaster insurance. Look for a company that provides comprehensive coverage for the types of disasters that are most prevalent in your area. Compare coverage options from multiple insurance companies to find the policy that best meets your needs.

Tips for Filing a Claim

If you find yourself in the unfortunate situation of needing to file a claim for damage to your home due to a natural disaster, here are some tips to help make the process go smoothly:

Document the Damage

Before making any repairs to your home, be sure to document the damage thoroughly. Take photos and videos of the damage from multiple angles to provide evidence for your insurance claim. This documentation will help support your claim and ensure that you receive the compensation you deserve.

Contact Your Insurance Company

As soon as it is safe to do so, contact your insurance company to report the damage and file a claim. Be prepared to provide details about the extent of the damage and any documentation you have collected. Your insurance company will guide you through the claims process and help you understand what steps need to be taken.

Review Your Policy

Before moving forward with any repairs or replacements, review your insurance policy to understand what is covered and what is not. Your insurance agent can help clarify any questions you may have about your coverage and deductibles. Understanding your policy will help ensure that you receive the appropriate compensation for your claim.

Conclusion

Disasters can strike at any time, and having the right insurance coverage in place can provide peace of mind knowing that your home and property are protected. By understanding the basics of disaster insurance for homeowners and choosing the right policy for your needs, you can rest assured that you have the financial protection you need in the event of a natural calamity. Be sure to review your policy regularly and make any necessary adjustments to ensure that you have adequate coverage for your home.